The Overlooked Half of the Global Stock Market

Mon Dec 17 2018 by Brian StanleyThe US stock market is the largest and most liquid stock market in the world and tends to get all the attention. Many brokers and trading platforms are US-only, and many traders focus exclusively on the US market.

This post compares the number of stock listings in each of 17 countries to quantify what traders miss out on by ignoring the rest of the world.

The Countries

I compare 17 countries which can be traded through Interactive Brokers, excluding countries for which no or limited historical data is available through the IB API. The regions and countries are:

- Asia/Pacific (Australia, Hong Kong, Japan, Singapore)

- Europe (Austria, Belgium, France, Germany, Italy, Netherlands, Spain, Sweden, Switzerland, United Kingdom)

- North America (Canada, Mexico, United States)

The US versus the Rest

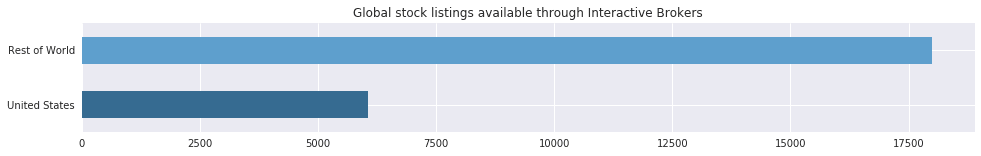

How does the US market compare to the rest of the world? There are about 6,000 listed stocks in the US (excluding OTC) and about 18,000 in the rest of the world:

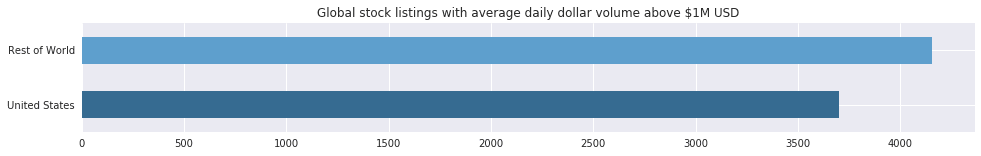

By this measure, US-only traders overlook 75% of the global stock market. However, some of the overlooked 75% consists of illiquid stocks, and many quantitative trading strategies depend on having sufficient liquidity for trading in and out of positions. Let's limit our comparison to stocks with 2018 average daily dollar volume greater than $1M USD equivalent:

By this definition of liquid, the US has about 3,700 liquid stocks while the rest of the world has about 4,200. US-only traders are missing out on just over half of the liquid global market.

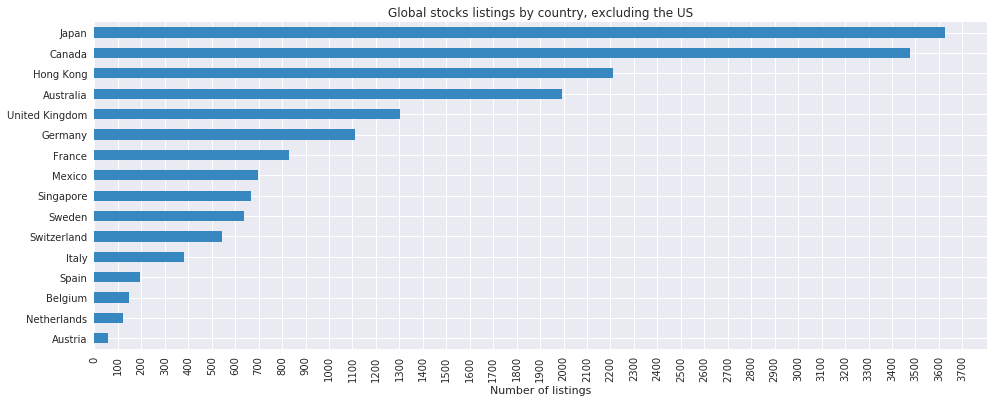

Global stock listings by country

So, where are these global listings? Japan has the most listings at 3,600, with Canada in a close second. Hong Kong and Australia each have approximately 2,000 listings. Europe's listings are spread across a larger number of countries, with fewer average listings per country.

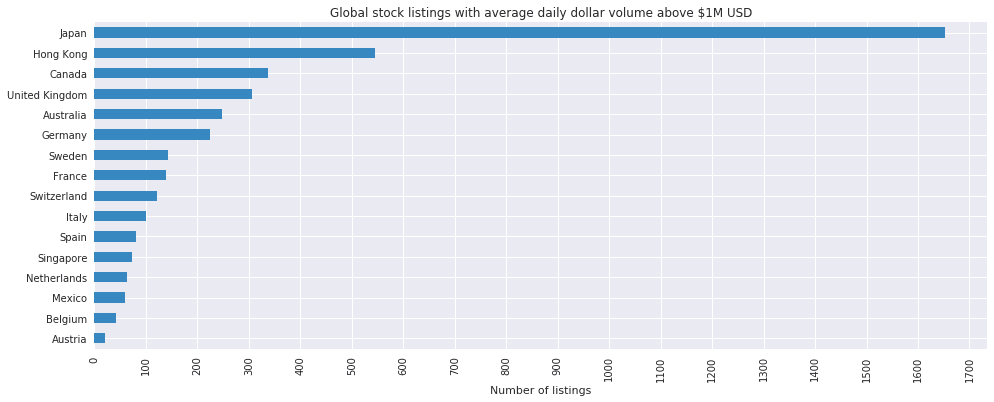

If we limit the analysis to listings with 2018 average dollar volume above $1M USD equivalent, Japan is the dominant non-US market, with Hong Kong second. The number of Canadian listings drops precipitously from the previous chart, with only about 10% of Canadian listings being liquid by our definition.

Conclusion

US stocks constitute only 25% of global listings and fewer than half of liquid global listings. Traders looking to get started with international markets may want to explore Japan, which has the largest stock market outside the US.

Explore this research on your own

This research was created with QuantRocket. Clone the global-market-profiles repository to get the code and perform your own analysis.

quantrocket codeload clone 'global-market-profiles'