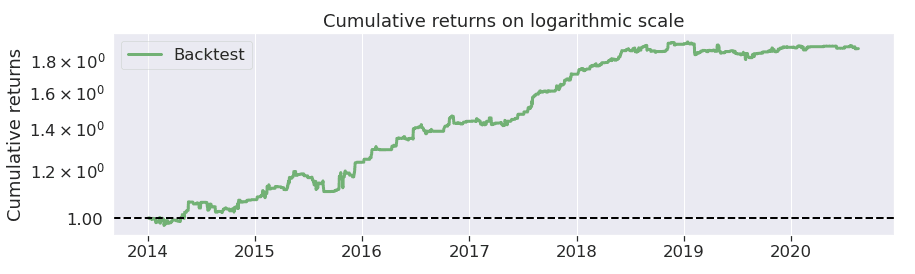

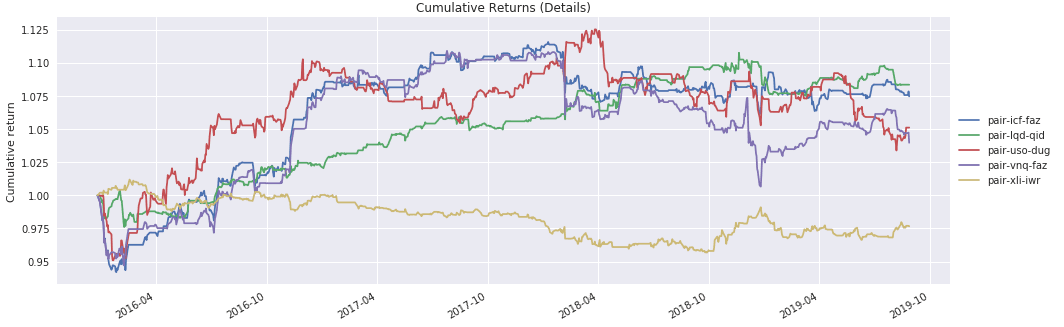

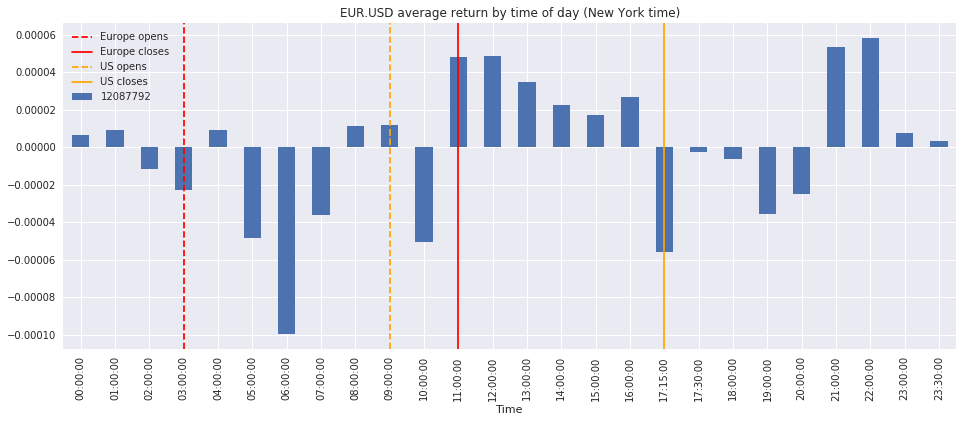

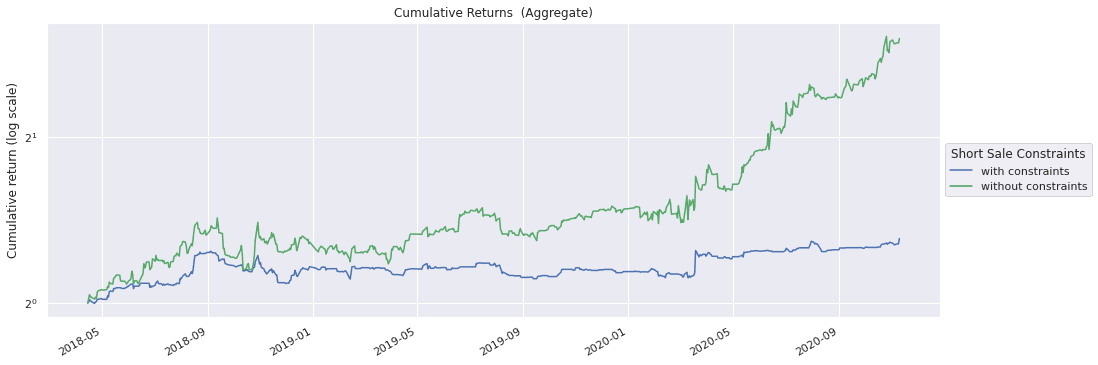

What happens after stocks suffer large one-day losses? This post finds that the proverbial "dead cat bounce" occurs overnight and is followed by continued losses the next day. Targeting international markets, I explore a trading strategy that aims to profit from the losses that follow a dead cat bounce.